Those investors known as sector rotators try to judge the most attractive parts of the market and weight their portfolios accordingly. Often they do so based upon their assessment of where we are in the economic or market cycle, as a simple Google search on the term will demonstrate.

The “how” of it varies from manager to manager, with some being index huggers and others willing to have more concentrated bets. Many of the managers have gotten much more global in the last couple of decades, so the amount of currency risk is another factor to consider.

Interestingly, the standard reports of many data providers (and those of in-house systems) use those same sectors, whether the manager is a sector rotator or not, which sets up lines of codification that affect decision making that most people don’t think much about.

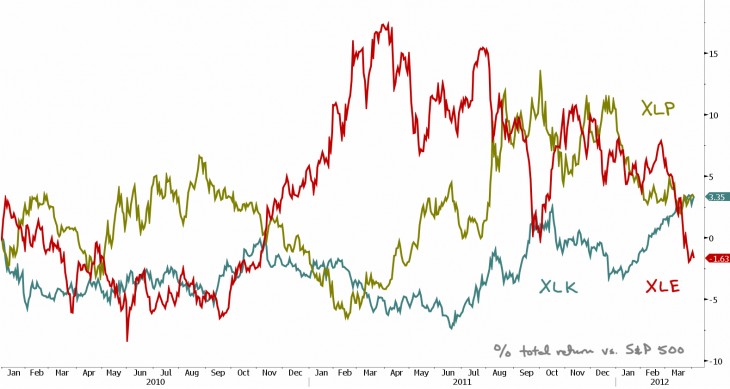

In any case, the chart above shows the relative performance of three of the domestic sectors since the end of 2009, as represented by their ETFs. Energy (XLF) has been under pressure of late, while technology (XLK) has done well (on the back of AAPL especially). The consumer staples (XLP) have lagged the strong market so far this year.

It’s quite an interesting picture, with all three close to where they began. No one said this was easy. (Chart: Bloomberg terminal.)