by James Paulsen, Chief Investment Strategist, Wells Capital Management (Wells Fargo)

Since 1945, the U.S. stock market has fluctuated between valuation and earnings cycles. Both the scope and scale of these recurring valuation/earnings cycles have been remarkably similar. As the S&P 500 rises above 1400 for the first time since 2008 and as the possibility of a new all-time record high lingers in the not too distant future, some insight may be gained by appreciating the repetitive nature exhibited by U.S. stocks during the post-war era.

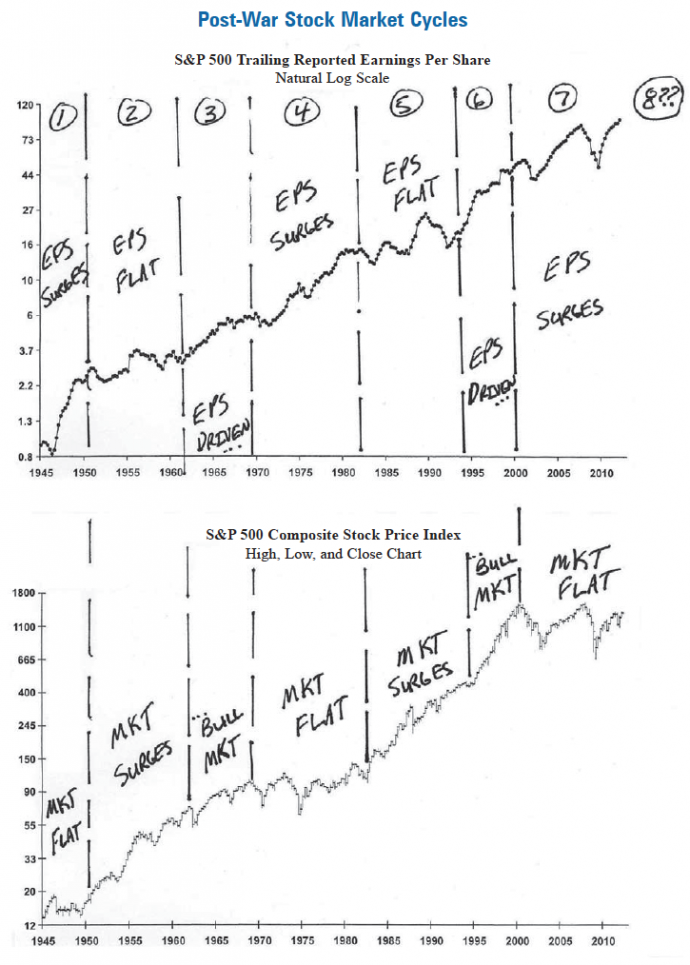

The accompanying exhibit compares trailing four-quarter earnings per share to the S&P 500 Stock Price Index since 1945. As highlighted by the exhibit, the post-war U.S. stock market can be described by a recurring three-step cycle:

Stage 1. Earnings Production—Earnings surge while stock prices trend sideways over a series of years.

Stage 2. Getting Paid—A valuation-driven stock market whereby investors are finally “paid” for earnings previously produced. Stock market surges even though earnings per share trend sideways.

Stage 3. Traditional Run—A stage whereby both earnings and stock prices rise—i.e., a traditional earnings-driven stock market.

This historic cycle—earnings production, getting paid, and the traditional run—has already begun its third iteration of the post-war era. While each repetitive cycle has of course been unique, they all have shown a tendency to rhyme!

Post-War Cycle #1 – 1945 to 1970

After being roughly flat for more than 15 years (i.e., between 1930 and mid 1940s), earnings per share on the S&P 500 Index nearly tripled (from about $1 to almost $3) between 1945 and the end of 1950. Despite the fastest earnings growth of the post-war era, the overall stock market remained essentially flat during this period as country-wide confidence was extremely low in the aftermath of the Great Depression and WWII. These concerns and escalating post-war inflation combine to lower the priceearnings multiple (PE) during the “earnings production” stage of cycle #1.

In the next stage of the cycle (Getting Paid) lasting roughly from 1951 until 1961, the stock market rose 3.5-fold even though earnings per share flat lined. Essentially, confidence throughout the country was slowly resurrected and as fears subsided PE valuations rose steadily allowing investors to finally “Get Paid” for the earnings which actually were produced in the late 1940s.

Finally, the first post-war stock market cycle was capped by a “Traditional Run” stage lasting from the early 1960s until about 1970. During this final stage, the stock market simply followed earnings gains higher as both earnings and stock prices rose by about the same amount.

Post-War Cycle #2 – 1970 to 2000

Between 1970 and 1982, the S&P 500 Stock Price Index remained essentially unchanged despite an almost tripling of earnings per share (i.e., S&P earnings per share rose from about $5 to about $15— quite an “Earnings Production” stage)! PE multiples were cut by almost two-thirds during this period as the economy was overwhelmed by runaway inflation and surging bond yields.

In the “Getting Paid” stage between 1982 and 1994, the stock market surged by almost four times even though earnings rose only modestly and essentially trended sideways during the period. As the inflationary spiral broke in the early 1980s, inflation expectations slowly calmed, bond yields began a secular decline, and the PE multiple rose from about 8 times at the low in 1982 to about 22 times trailing earnings per share by early 1994.

In the last “Traditional Run” stage of post-war stock market cycle #2, both earnings and stock prices generated excellent results. Between mid 1994 and the peak in 2000, earnings per share rose about 2.5 times while the stock market rose by about 3.2-fold! Although PE valuations did continue to rise in this stage, most of the gain in stock prices was due to the technological-driven boom in earnings performance.

Post-War Cycle #3 – 2000 to ????

The contemporary stock market cycle, the third of the post-war era, began at the dot-com stock market peak in 2000. Since, although the stock market has trended sideways in a volatile range, earnings per share have demonstrated stellar results—almost doubling during this period from about $55 at the 2000 peak to nearing almost $100 today. Similar to the previous two stock market cycles, the last decade epitomizes the character of the “Earnings Production” stage.

Although the overall gain in earnings in the contemporary cycle is less than the near tripling of earnings which occurred both in the late 1940s and during the 1970s (although in both periods, earnings were assisted by faster inflation than has occurred since 2000), a near doubling of earnings with a flat overall stock market is still very reminiscent of stage 1. The question for investors is whether the contemporary stock market cycle (the third of the post-war era) will continue to exhibit a close similarity to the two previous cycles? For if it does, the “Earnings Production” stage is probably nearing its conclusion and the “investor reaping stages” (i.e., the “Getting Paid” and “Traditional Run” stages) may lie directly ahead!??

Concluding Comments, Speculations, and a Little Math?

History will not perfectly repeat itself. However, the stock market has exhibited a remarkable repeating cycle in the post-war era which should not be ignored. Already, the experience of the last “lost decade” looks amazingly similar to the character of the “Earnings Production” stage which occurred at the beginning of each of the last two stock market cycles.

In the 1970s cycle, the driving force behind the 1980s-1990s stock market bull run was a secular decline in bond yields. This catalyst is not available today since yields cannot decline any further. However, the “next couple stages” of the contemporary stock market cycle could rhyme closely with the 1950s-1960s stock market bull. In this instance, the primary catalyst was a slow but steady resurrection of economywide confidence after it was destroyed during the Great Depression and WWII. Even though interest rates rose throughout the 1950s-1960s era, the stock market continued to advance as valuations and earnings improved despite rising yields since confidence was rising from such depressed levels.

Could the 1950s-1960s stock market run be a potential blueprint for the next two stages of the contemporary stock market cycle? Similar to the aftermath of the Great Depression, today interest rates are near all-time record lows and simply cannot decline much further. Also, confidence in the early 1950s was cautious after the depression and the war just as it is today after 9/11, Iraq, and the Great Crisis of 2008. Like the 1950s-1960s bull, could a slow but steady resuscitation of confidence in the next several years provide the catalyst for another buy-and-hold era?

The next two stages may depart from the character of the last two stock market cycles. The contemporary cycle could be prematurely aborted by numerous problems including another financial crisis, a war or simply a renewed period of escalating inflation. However, if this cycle does continue to “rhyme” with the previous two post-war cycles what does some simple math suggest about possibilities?

Currently, share earnings on the S&P 500 are closing in on $100. If we soon enter “stage 2” of the stock market cycle (i.e., “Getting Paid” where earnings growth is subdued if it grows at all), earnings growth will likely prove very modest in the next several years. Assume earnings per share only rise at a pace slightly less than nominal GDP growth. And, further assume only a very modest 5 percent annualized gain in nominal GDP during the next five years (i.e., 2.5 percent inflation and 2.5 percent real growth). If earnings per share grow at an annualized pace of 4 percent during the next five years (i.e., 1 percent slower than nominal GDP), share earnings will be about $122. Finally, assume that with such modest (but sustained) growth in nominal GDP, the inflation rate and the 10-year bond yield remain low by historic standards. Under such assumptions, it seems likely confidence will be slowly restored (similar to the 1950s) as the Great Crisis of 2008 fades in memory and as the economic recovery persists leading to an eventual rise in the S&P 500 PE multiple. Assuming only a modest increase in the PE multiple during the next 5 years to around 17, the target price on the S&P 500 would be 2074. From the current level of around 1400, this would yield investors about an 8.2 percent annualized price return. Adding dividends would provide investors with a buy-and-hold total annualized return in excess of 10 percent!

Who knows what investors will face during the next five years? However, if the contemporary stock market cycle continues to rhyme with the past, perhaps investors can “dream a little” about the prospects of another period of “Getting Paid” and a “Traditional Run”!!?